How do Bond Yields work?

Bonds are crucial in the investment market. They are a low-risk option for investors that generates returns.

Bond yield helps investors determine how much income they can expect and compare bonds of various terms and issuers. The outstanding Indian bond market stood at US$2.59 trillion in 2024. Its growth rate in INR terms is 12.3% annually compared to the previous year.

This guide will discuss bond yields, their various types, and their significance in sound investment decision-making.

What are Bonds?

IPOs help raise funds to cover the company’s operational activities. However, what if the company requires more funds later on?

Bonds are excellent instruments issued by companies to raise capital. They are debt instruments in which a company issues bonds to the lender, called the bondholder. The company promises a periodic fixed interest on the principal amount to the lender, known as a coupon.

What is a Bond’s Yield? Meaning and Definition

Investors need to understand bond yields to measure the profitability of their bond investment. Bond yield helps compare different bond instruments and anticipate the approximate return an investor can hope to get. It’s the bond-generated annual income percentage relative to its market price or face value. The bond yield at face value is the coupon rate.

Bond yield is a critical aspect of any investment. It depends on changes in interest rates, the maturity of the bond, and credit risk. Hence, it is a great way for investors to assess their potential earnings from bond investments.

Example:

Let’s understand an example of G-Sec: Mr. XYZ buys a 10-year Indian Government Security bond. The face value is set at ₹1,00,000 with an annual coupon rate of 7%, and the bond pays ₹ 7,000 as interest every year.

Assume that the bond is quoted in the secondary market and sells at a price quite sensitive to the prevailing interest rates and other market forces. Suppose now that the bond price has arrived at ₹95,000, below the face value. Then, the current yield shall be as follows:

Current Yield = Annual Coupon Payment/Current Market Price = 7,000/95,000, which is 7.37%

Instead of the face value, Mr. XYZ will receive a 7.37% return from the market price.

If Mr. XYZ holds this bond to maturity when the government returns its face value to ₹1,00,000, he will receive a capital appreciation of ₹5,000 since he purchased it at ₹95,000. This capital gain is part of YTM.

Types of Bonds

Let’s learn about the two basic types of bond yield: corporate bonds and government bonds.

Here are some facts for understanding the importance of the two categories:

- By 2024, the 10-year Indian Government Bond yield will be between 6.77% and 6.80%. These rates reflect higher interest rates and inflationary trends in the economy.

- Highly rated AAA bonds in India yield 7.5%, with the latest offering at least 300 basis points over the expected inflation rate. Lesser-rated bonds garner more rewards due to higher credit risks.

- The amount of corporate bonds mobilized in the first half of this fiscal saw a 6% rise to ₹4.98 lakh crore from ₹4.7 lakh crore in 2024 for the same quarter last year.

Different Types and Examples of Government Bonds

- Floating Rate Bonds

- Sovereign Gold Bonds: Investment in gold through such bonds without investing in actual gold.

- Fixed-Rate Bonds

- Inflation Indexed Bonds: Such bonds’ principal and interest accruing are inflation-indexed.

- GOI Savings Bonds: This G-Sec was launched in 2018 to replace the 8% Savings Bond. The interest rate on such bonds is 7.75%.

- Bonds with Call or Put Option: The issuer can buy back such bonds, known as a call option, or the investor can exercise its right to sell them to such an issuer.

- Zero-Coupon Bonds: Zero-coupon bonds earn no interest. Income comes from the issuance price at a discount and the redemption value at par.

Different Types and Examples of Corporate Bonds

Corporate bonds can be divided into various categories. These are:

- Senior Secured Bonds: They receive very high priority in the payout and are secured by the collaterals assigned.

- Senior Unsecured Bonds: They are paid after all the secure bondholders.

- Junior and Subordinated Bonds: These bonds do not carry any collateral as a guarantee.

- Insured and Guaranteed Bonds: These bonds are covered by an independent third party.

Some bonds with characteristics of equity:

- Convertible Bonds: These can be converted into equity shares.

- Non-Convertible Bonds: These are pure debt securities.

Depending upon the rate of interest:

- Fixed-Rate Bonds

- Floating-Rate Bonds

- Zero-Coupon Bonds

Depending upon the maturity period:

- Short-Term Bonds: The maturity period is less than a year.

- Medium-Term Bonds: The maturity period falls between 1 and 5 years.

- Long-Term Bonds: Maturity period that exceeds 5 years.

How is Bonds Yield Calculated?

Bond yield calculation gives investors an idea of the return they will get from the interest accrued by holding a bond. Some of the key techniques of bond yield computation are:

1. Coupon Yield or Nominal Yield on Bonds

A coupon or nominal yield divides the bond’s annual coupon income by its face value.

Suppose Mr. XYZ has a bond with a face value of ₹10,000. Every year, he draws an interest of ₹900. The nominal bond yield can now be calculated as 900/10,000 = 9%.

However, this applies only to bonds with a fixed coupon rate. For floating-rate bonds or floaters, the coupon rate would also be floating. Investors must ascertain the total interest obtained in the year and divide it by the face value to get the average nominal yield.

2. Current Yield on Bonds

Because bonds are traded in the secondary market, they can be sold above or below their face value. Thus, their prevailing market price also impacts the bond yield.

Current yield or bond yield rates consider the bond’s market price instead of its face value as the denominator.

Formula: Current yield = Annual Coupon Payment/Current Price of the Bond

Let us consider the same example. We have seen the ₹10,000 bond that pays ₹900 as a coupon in a year. Here, we will consider two scenarios: the bond price is ₹9,800 and the other where the bond price is ₹10,300.

In the first case, the current yield of the bond will be 900/9,800 = 9.18%

In the second case, the current yield on the bond will be 900/10,300 = 8.74%

The current yield is useful since it considers the market price. It is a good measure of how much returns can be expected if investors enter the market through the secondary bond market at the current price.

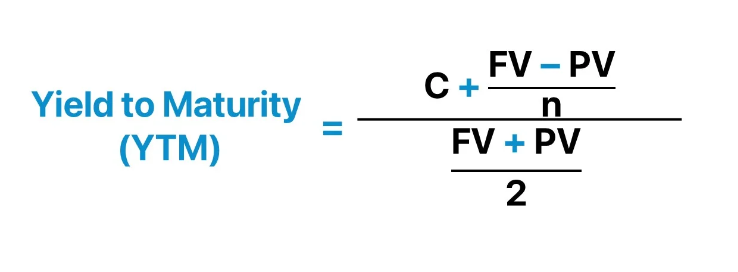

3. Yield To Maturity (YTM)

This represents the most important yield for bond traders.

YTM refers to the annual rate of return a bond generates if it is held until maturity. It considers all coupon payments and the return of principal when the bond matures.

Where:

- C = Annual coupon payment

- FV = Face value of the bond

- PV = Current price of the bond

- n = Years to maturity

Yield to maturity is also helpful as it converts all future cash flows into present value terms; YTM is affected by coupon rate, issue price, redemption price, coupon frequency, etc.

4. Yield to Call (In Case of Callable/Redeemable Bonds)

When companies issue bonds at high interest rates, they keep an open fallback option in case of a sharp decline in interest rates. Normally, the issuer can exercise the call option at the end of five years or so. If interest rates are low, the issuer can call back the bonds to save interest costs and borrow fresh in the market at lower rates.

In such a case, investors must know about Yield to Call (YTC), assuming that the bond issuer exercises the call option. YTC is the annual rate of return at the bond’s next call date.

5. Tax Equivalent Yield

This specific form of yield can apply only to tax-free bonds.

Infrastructure companies in India issue tax-free bonds, wherein the interest rate is fully tax-free in the hands of the investor. Due to their status, tax-free bonds pay a lesser rate of return. Thus, one needs to calculate their tax-equivalent yield to compare the two.

6. Inflation-Adjusted Yield

Inflation-indexed bonds are products like those issued by the Government of India, whose interest payments or principal are indexed according to inflation. These bonds become important when inflation is high, as traditional bond yields cannot keep pace with the increased price.

Factors Affecting Bonds Yield

Many factors might influence the yield of a specific bond:

1. Interest Rates

Interest rates are probably the factors that most affect bond yields. Benchmark interest rates, set by the RBI, are crucial for government and corporate bond yields.

2. Credit Risk

The bond issuer’s credit risk also affects yield. G-Secs are considered risk-free since the sovereign government fully backs them; therefore, their yields tend to be relatively lower.

3. Inflation

Inflation is determined as a reduction in the purchasing power of future interest payments, so bond yields have to rise to adjust for this loss to offset investors. Such yields tend to rise along with high inflation to provide an equilibrium real return positive after controlling for inflation and fall during low-inflation periods.

India’s annual inflation rate for September 2024 was reported at 5.49%, higher than August’s 3.65%, although above the market expectation of 5%. This has been impacting investment decisions, which require the investor to invest only in bonds that offer returns over this level to have real returns.

4. Liquidity

Government securities are characterized by high liquidity and are regularly traded in the secondary market, reducing yields to low levels.

Interrelation Between Bond Yield and Price

Bond prices and yields move inversely to each other. This concept revolves around the effects of factors like interest rates on the bonds in the market.

The Inverse Relationship Explained

An increase in interest rates means that newly issued bonds have a greater coupon rate than the existing lower coupon-rate bonds and are less attractive. Since borrowing money is now more costly, their market prices decline.

When interest rates decline, newly issued bonds with lower coupon rates become less appealing to investors. In the market, high coupon rate bonds become highly priced.

Bond Yield ∝ 1/Bond Price

This is because a bond’s yield is calculated based on the coupon payment it generates compared to its current price. The more bond prices decline, the higher the yields become, and as bond prices rise, the yields decline.

For example, if Mr. XYZ buys a bond with a face value of ₹10,000 at a price of ₹9,800, then yields will be higher at 9.18%. But if he purchases the same bond for ₹10,300 today, yields stand at 8.74%. He would prefer buying at a lower price to earn more from yields but would like the price to rise so that he can sell the bond at a premium.

How Interest Rates Work

With higher interest rates, prevailing bonds sell at lower prices. This is because newly issued bonds promise a higher coupon rate and are more desirable to investors. However, with a decrease in the interest rates, the existing higher coupon-rate-bearing bonds become more attractive, and their price shoots up.

Supply and Demand Conditions

Price movements also rely on supply and demand conditions. When uncertainty about the economy dominates, individuals invest in bonds, creating an upward slope in bond prices and downward movements of yields.

How Bond Yield is Significant for Investors

Bond yield leads investors on whether to invest in government bonds or corporate bonds:

- Yield as a Measure of Returns: Lower yields as government bonds face a lower risk than corporate bonds. Higher yields compensate for the extra credit risk associated with corporate bonds.

- Yield and Risk Evaluation: Yield represents an indirect measure through which one can assess the risk of a bond investment. Higher yields represent higher risks.

- Yield and Inflation: Real yield is greater than nominal yield in an inflationary period. When inflation is higher than a bond’s yield, the investor’s purchasing power is reduced.

- The Role of Yield in Portfolio Diversification: Bond yield can help investors choose bonds for portfolio diversification, especially in volatile markets.

Conclusion

Bond yield is a significant measurement that leads to wise decision-making in bond markets. Bond yield represents the expected returns generated from bonds, whether through the current yield, the yield to maturity, or other kinds of yields.

It is a handy tool for assessing income potential and considering the risk while making strategic decisions for diversifying an investment portfolio.

FAQs

1. What is Yield to Maturity?

Yield to maturity is the percent of return on a bond calculated as a percentage; it indicates the overall profitability of a bond and varies based on the “purchase price” rather than simply the bond’s “coupon rate.”

2. What is the approximate yield on Indian bonds?

The benchmark yield for a 10-year Indian bond may fall between 6.77 and 6.80%.

3. What is bond yield?

A bond yield is the annual return on a bond. It is the ratio of the total amount earned in a year from the bond via interest and principal repayment related to its current market price.

4. What drives bond yields up?

Bond yields go up because higher interest rates reduce the value of outstanding bonds. The yield on a bond depends on three factors: the price paid for the bond, the coupon rate, and the number of years until the bond matures. When yields rise, the prices of outstanding bonds fall.

Disclaimer: The information provided is for informational purposes only. PowerUp is not responsible for errors, omissions, or outcomes related to using this information.